Regional Governments to Develop Leading UKM Products In their Areas

April 19, 2021

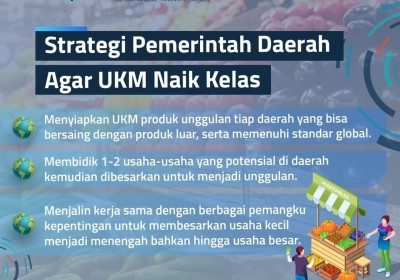

JAKARTA – The Ministry of Small-to-Medium Scale Businesses (UKM) and Cooperatives (KemenkopUKM) is pushing regional governments to identify and develop leading UKM sectors in their regions to boost the presence of local goods in the domestic market.

UKM Minister Teten Masduki underlined the importance of doing so in order to highlight Indonesia’s UKM products’ ability to compete in the international market and ensure that their products meet global standards.

“We import a lot of things, even though we have the ability to produce the things that we import ourselves,” Minister Teten said in a written statement on Sunday (28/3).

That is why Minister Teten is asking regional governments to identify one or two leading UKM industries in their regions in order to intensify and develop these industries further.

Also, the KemenkopUKM is supporting UKM upscaling efforts by partnering with private sector incubators. This is in line with the conditions of a Presidential Decree (Perpres) on entrepreneurial practices that is currently being discussed and formulated.

“The target is to ‘upgrade’ these businesses from their current status as micro-businesses, due to the fact that most micro-scale businesses tend to be overlooked by formal sectors,” the minister explained.

KemenkopUKM is currently active in forging partnerships with various stakeholders to upgrade small-scale and micro-scale businesses into larger enterprises. Minister Teten also pressed that UKMs participating in incubation programs must do so for at least for 6 months and their products must be tested by experts before they are deemed ready for the market.

It is only after the product is fully developed and the market demand is stronger, that the funding process will begin.

“We are lagging behind Vietnam. Over there, they have prepared up to Rp 19 billion to fund their UKMs and have successfully produced new entrepreneurs and businesses,” the minister added.

Minister Teten also noted that the government has simplified conditions inside the Revolving Fund Management Institution (LPDB-KUMKM) so that partnerships and UKM development efforts can be more easily conducted.

Going forward, the ministry plans to hold a series of trials which involves consolidating products made by farmers and cooperatives as off takers. The ministry will also give special developmental attention to UKMs that they feel have the potential to ‘upgrade’, which will help increase the number of entrepreneurs in Indonesia, currently stagnating at 3.47%.

The LPDB-KUMKM’s director of business development Djarot W Wibowo elaborated that since 2020, the KemenkopUKM has loosened the rules regarding LPDB-KUMKM applications through KemenkopUKM Decree No. 4/2020, which does away with compulsory credit insurance and changes the conditions for cooperatives who wish to apply for 2 years of operation, to only 1 year. Adding to that, the LPDB-KUMKM account requirement is at a minimum of 6 months.

“For the insurance relaxation, we are working together with city-owned lender Jamkrida in order for them to be able to anticipate any problems regarding credit insurance. Jamkrida can also become a business partner for UKMs because of their experience in guiding UKMs themselves,” he said.

Djarot acknowledged that revolving fund financing through the Syariah system will be more focused on real sectors.

Indonesia’s Research Institutions Supporting the Development of the Electric Vehicle Industry

Indonesian Muslim Fashion and Cosmetics IKMs Shine at Dubai World Expo 2020

Govt Steps Up UMKM Transformation Efforts in the Midst of Pandemic Slowdown

Govt Encourages Promotion of IKM Products in Digital Era

Government Begins Developing Maritime Training Center in Makassar

Tweets by IDDevForum