Luxury Tax Relief Scheme Hopes to Stimulate Automotive Industry

February 17, 2021

The government continues to issue new fiscal incentives to help the national economic recovery program (PEN) during the COVID-19 pandemic. One of the government’s strategies is to introduce a luxury tax (PPnBM) reduction scheme for automobile vehicle purchases starting from 1 March 2021.

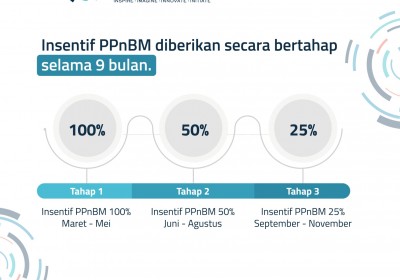

The scheme will run for the next 9 months, throughout 2021, and will comprise of three different phases. The first phase, which offers 100% relaxation, will be carried out between March and May, the second phase, which offers 50%, will be done between June and August while the final phase of 25% will be carried out between September to November. The size of the reductions will be revised every 3 months.

Relaxing the luxury tax rate will not only benefit the consumers but also automotive producers. It can also help improve the national revenue stream. The government hopes that through this fiscal incentive, demand for automotive goods and services will increase, along with the capacity rates of production factories. Through this scheme, the automotive industry is targeting to increase production by 81,752 units and contribute Rp 1.62 trillion to the national economy.

“The main benefiters of this incentive are the consumers, not for the producers or the companies. We have calculated that if the luxury tax is upheld, then income tax rates will increase,” Coordinating Economic Minister Airlangga Hartarto said during the ‘Leverages to Economic Recovery’ dialogue event on Tuesday (16/2) as quoted in a press release by the Coordinating Economic Ministry. The luxury tax relief is expected to drive down the price of automobiles and vehicles in order to increase public demand and increase production rates as a result.

Adding to that, Finance Minister Sri Mulyani said that this tax relief scheme is supported by Bank Indonesia and the Financial Services Authority (OJK) to help push vehicle credit plans that have 0% down payment rules that can drive down risk weight assets (ATMR). She also hoped that this policy would be welcomed by vehicle dealers and producers.

“We hope that this scheme will give an added boost to vehicle sales in Indonesia, which has been increasing since July 2020,” Minister Sri said in a press release by the Finance Ministry on Saturday, 13 February.

Jongkie D. Sugiarto, the head of the Association of Indonesian Automotive Manufacturers (Gaikindo), said that the industry will welcome the luxury tax relaxation scheme with open arms due to its benefits towards making prices more affordable for the public and also in bringing in a new dynamic to the industry.

“We hope that the demand for automotive vehicles will increase as a result, which would help production factories return to its optimum production rates as soon as possible,” Jongkie said on Sunday (14/2) as quoted by Kontan.co.id.

Meanwhile, Indonesia Chamber of Commerce (Kadin) vice chairperson Shinta Widjaja Kamdani also said that the government’s decision to provide tax incentives to the public is a welcome one for the industry. Aside from driving the recovery of the automotive industry, the scheme also supports the underlying fact that the public is currently more dependent on private vehicles rather than public transport due to COVID-19 prevention protocols.

Sales of four-wheeled vehicles fell by 48% (year on year) in 2020, and total vehicle sales that year only amounted to 532,065 units. This is the lowest sales volume the industry had recorded in Indonesia in the last 10 years. In comparison, over 1 million four-wheeled vehicles were sold in Indonesia in the whole of 2019.

The government is hoping that an increase in vehicle production will help other supporting industries that also function within one ecosystem, such as the automotive industry. The automotive industry is considered part of the manufacturing sector, and contributes the largest output to the national economy, making up 20% of the gross domestic product (GDP). As a labor-intensive industry, it currently employs up to 1.5 million workers, as stated by the Coordinating Economic Ministry.

Indonesia’s Research Institutions Supporting the Development of the Electric Vehicle Industry

Indonesian Muslim Fashion and Cosmetics IKMs Shine at Dubai World Expo 2020

Govt Steps Up UMKM Transformation Efforts in the Midst of Pandemic Slowdown

Govt Encourages Promotion of IKM Products in Digital Era

Government Begins Developing Maritime Training Center in Makassar

Tweets by IDDevForum